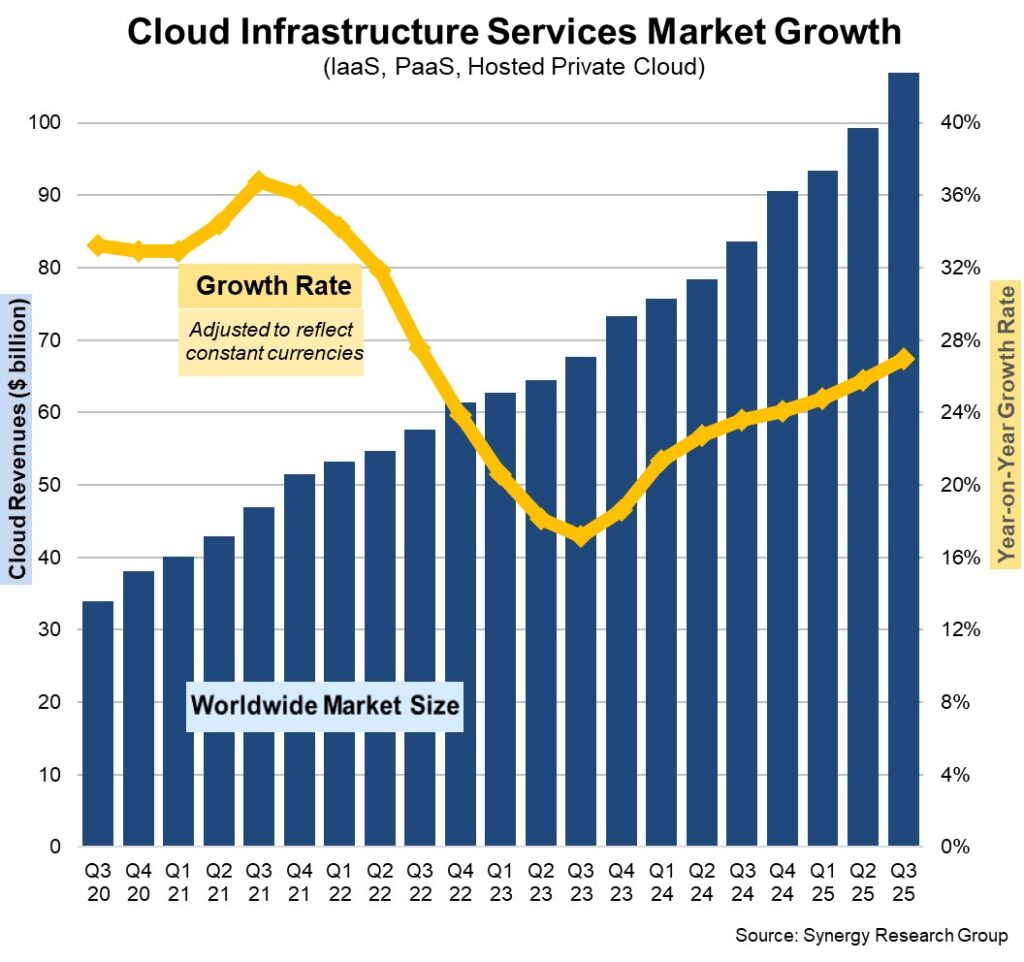

New data from Synergy Research Group shows that Q3 enterprise spending on cloud infrastructure services jumped by over $7.5 billion from the previous quarter, which is by far the biggest ever sequential increase.

Backing out the impact of some major currency fluctuations over the period, this represents growth of 28% from the third quarter of last year, and it’s the eighth successive quarter of increasing year-on-year growth rates. It’s also the highest growth rate the market has seen in three years.

GenAI is clearly the major driver of these changing market dynamics. Among the major cloud providers Amazon maintains a strong lead in the market though Microsoft and Google continue to achieve higher growth rates. Their Q3 worldwide market shares were 29%, 20% and 13% respectively.

Among the tier two cloud providers, those with the highest growth rates include CoreWeave, OpenAI, Oracle, Databricks and Huawei. From a virtual standing start two years ago, CoreWeave is now achieving well over a billion dollars in quarterly cloud revenue and is close to joining the top ten ranking of cloud providers, thanks to its AI and GPU services.

With most of the major cloud providers having now released their earnings data for Q3, Synergy estimates that quarterly cloud infrastructure service revenues (including IaaS, PaaS and hosted private cloud services) were $106.9 billion, with trailing twelve-month revenues reaching $390 billion. Public IaaS and PaaS services account for the bulk of the market and those grew by 30% in Q3.

The dominance of the major cloud providers is even more pronounced in public cloud, where the top three account for 67% of the market. Geographically, the cloud market continues to grow strongly in all regions of the world.

When measured in local currencies, the major countries with the strongest growth included India, Australia, Indonesia, Ireland, Mexico and South Africa, all growing at rates above the worldwide average. The US remains by far the largest cloud market, with its scale far surpassing the whole APAC region.

The US market grew by 27% in Q3. In Europe the largest cloud markets are the UK and Germany, but the big markets with the highest growth rates were Ireland, Spain and Italy.

“Q3 market numbers were simply very impressive with a record-breaking sequential increase and yet another jump in growth rates,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “The leading cloud providers all posted strong numbers, while the Chinese market is improving and neocloud companies are now making a real impact on the market. GenAI is driving a lot of the positive metrics, and as one example of that, revenues from GPUaaS are now growing by over 200% per year. That all adds up to a surging cloud market which bodes well for the coming years.”